Your Small contribution can make a big impact. As we all know “Drip fills the Ocean''. The idea of contributing to improve the lives of the impoverished and the needy has existed since time immemorial. From companies to individuals, people from all walks of life are known to contribute money for a better future for all. To encourage people to donate for good causes, the Income Tax Department allows one to claim exemption under Section 80G on the amount donated to charities and NGOs.

No, we don’t stop here; your small contribution will benefit you too, Surprised?

Yes, it’s true that you can save your Income Tax liability to much extent by becoming a part of our noble cause. Let’s look into interesting facts about Income Tax. Suppose, your total Income is Rs. 5,01,000/- then total tax payable is Rs. 13,208/- (Rebate is allowed only Income Up to 5,00,000. Hence, no rebate).

Now, if you donate 1,000/- to any Charitable funds then your total income is reduced to Rs. 5,00,000/- and Tax payable is Nil. Hence, by donating just 1,000/- you have saved Rs 12,208/- yourself, making it a win-win situation.

This way you are contributing to a noble cause while saving your Income Tax Liability.

Reasons to include donations in your Tax Planning:

- Options to donate

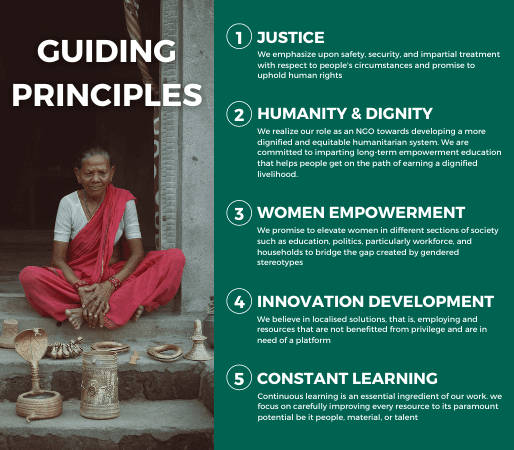

At Sarvpriye Foundation, we are working for Women Empowerment and Girl child education. We are working on the ground to make notable changes in the lives of women. All the donations are eligible for exemption under section 80G of Income Tax Act, 1961.

- Trust and Credibility

We bring both convenience and choice together for donors in a safe and high trust environment. At Sarvpriye Foundation, we take our donors' trust very seriously. We verify and validate all the legal requirements that a Non-Governmental Organisation needs to follow. We do all this so that our donors can donate with confidence that their giving is indeed doing what it is supposed to- Change Lives.

- Timely Reports

We understand that you want to know the difference your donations are making. And so, we will give you regular updates about the programs that you donate to.

- Consistent Schedule Plans

Donations made for tax saving can make a more significant impact if they are made in a regular and scheduled manner. As a donor, it gives you the convenience of planning the amount that you wish to invest to make a difference in the lives of people.

- Instant Tax Receipt in your Inbox

You will also be happy to know that we provide you a tax exemption receipt. Every donation made to Sarvpriye Foundation can be used to avail a deduction of up to 50% of the donated amount under section 80G of the Income Tax Act. It’s true that giving makes us all happy, in more ways than one!